In this post we are going to cover:

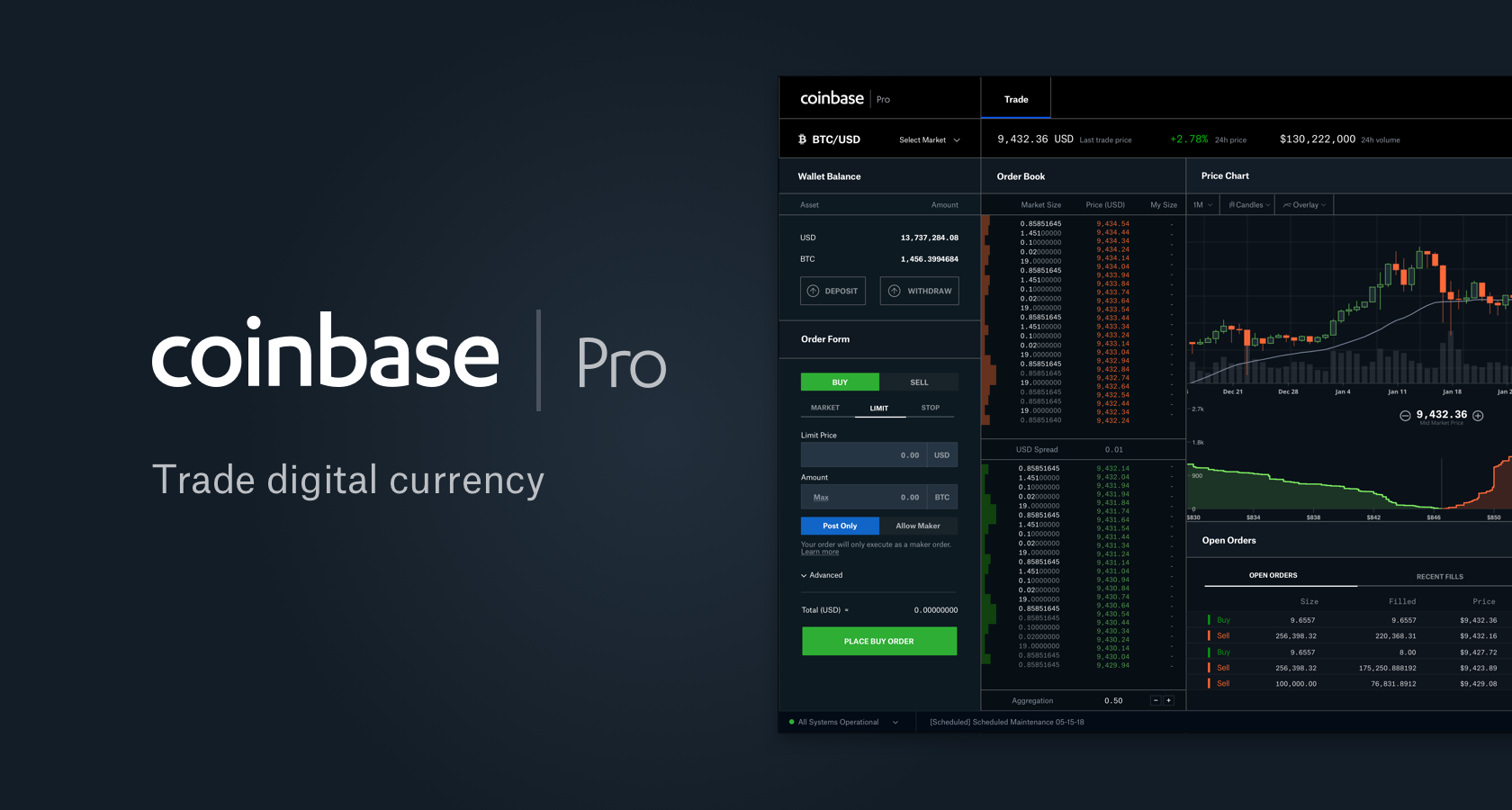

Coinbase advantages. This crypto exchange is one of the safest options out there. Coinbase has an incredibly clean, easy-to-use interface that’s free from clutter and a breeze to navigate. Coinbase review on trustradius gets a whopping 8.5/10 ranking! Has several products suitable for different traders and investors. Proactive customer service. Why should I use Coinbase Wallet? Coinbase Wallet is a software product that gives you access to a wide spectrum of decentralized innovation - buy and store ERC-20 tokens, participate in airdrops and ICOs, collect rare digital art and other collectibles, browse decentralized apps (DApps), shop at stores that accept cryptocurrency, and send crypto to anyone around the world. In this new Coinbase review for 2021, we cover everything you need to know about Coinbase’s flagship exchange (Coinbase.com). Coinbase allows its users to buy and sell a variety of cryptocurrencies including Bitcoin, Ethereum, Litecoin, EOS, Tezos, Stellar Lumens, Bitcoin Cash, and many others.

- if Coinbase keeps your data safe

- if Coinbase keeps your coins safe

- if Coinbase will let you withdraw your coins

- if Coinbase is a scam

Plus more... Read on to learn everything you need to know about Coinbase safety.

When you start out in crypto, your immediate impulse is to store your coins on the exchange you buy them from.

Coinbase is one of the well-known and popular places to buy Bitcoins.

Because of this, many people buy their coins there and never move them…but is this safe?

Will they keep your coins secure?

Will they let you withdraw them?

And will they respect your privacy

Find out everything you need to know about Coinbase and its history and security practices in this complete guide.

Introduction

In spite of Coinbase’s good record with fund management and suffering no significant losses since its October 2012 launch, there are still reasons to question the exchange’s security and safety.

This article breaks down three perspectives from which Coinbase might be vulnerable to attack or act in bad faith. We attempt to explain why choosing the more costly and inconvenient self-custodianship of your coins is preferable to handing that responsibility to Coinbase.

Ultimately, though, it’s up to you to decide whether you prefer to trust a bank with your Bitcoins, or you’re ready to take the first step towards financial sovereignty with a Billfodl and a hardware wallet.

Here is what we are going to cover in the following chapters - you can click each one to scroll directly to that chapter.

QUICK TIP: The best place to store coins after you buy is not on an exchange. You need to buy a hardware wallet like a Ledger or Trezor to store them yourself.

Is Coinbase a Safe Place to Store Bitcoins?

In a blog post from 2016, Coinbase CEO and Co-Founder Brian Armstrong has boasted about storing about 10% of bitcoins available in circulation.

Since then, the number of Coinbase users and corresponding investments has grown so much that the company generated billion dollar revenues just a year later.

While this might look like a good sign from a functional perspective, there are still reasons to feel doubtful and concerned.

Hacking Coinbase

Just because something is trusted by millions of users doesn’t mean that it’s secure and safe to be your custodian.

At the end of the day, trusted third parties are security holes and the whole point of Bitcoin is to participate in a permissionless system which grants you financial sovereignty.

Bitcoin history shows that titan custodians are bound to fall.

Though Coinbase didn’t lose funds in its first seven years of existence, its security should still be questioned and scrutinized.

The Bitcoin space still echoes with stories of financially ruinous events on exchanges.

Mt. Gox

The first Bitcoin exchange, which got hacked for almost 750,000 BTC.

Bitfinex

Lost 120,000 BTC when some unsecure multi-sig wallets broke.

QuadrigaCX

The owner unexpectedly died and took the private keys to customers’ with him.

Binance

Lost 7000 BTC in spite of constant “safu” claims.

Just because Coinbase hasn’t been hacked yet doesn’t mean that it’s invulnerable in the future.

The good record is just an indication of a better performance than the rest. Large amounts of bitcoins being stored in hot wallets for quick trades are perceived as honeypots for hackers.

The scariest part is that malevolent cyber attackers don’t even have to target the wallet encryption of an exchange like Coinbase: sometimes it’s enough to steal the sensitive user data and extort the exchange.

In a recent case, a hacker demanded for 300 BTC after breaking into Binance’s KYC (Know Your Customer) database and threatening to publish hundreds of pictures of users holding their national IDs for verification.

When negotiations failed,the attacker simply dumped the data in a Telegram group and exposed the kind of sensitive information that can be exploited by bad actors.

Furthermore, as a licensed American company, Coinbase must comply with both federal and state laws. If the US Government decides that bitcoins are illegal assets and all exchanges should freeze funds and stop trading, then it will have to act against the financial interest of its customers.

And even if financial compensations are given in USD (much like the case of the Gold Reserve Act of 1934) in exchange for the seized BTC, you still lose due to receiving a highly inflationary and depreciating asset that can be confiscated and censored by the government.

This is just hypothetical, but not impossible.

Coinbase Exchange

How is Coinbase Insured?

Since November 2013, Coinbase has insured user funds through Aon, the world’s largest insurance broker.

Furthermore, on the exchange’s support page it’s clearly stipulated that amounts up to $250.000 are insured and will be returned to customers in the event of a hacking or failure.

While this is definitely great, you should keep in mind that what you’re getting is infinitely inflatable fiat, not scarce bitcoins.

If your bits of digital gold get lost, it definitely won’t be Bitcoins that Coinbase and Aon send you as a form of compensation.

US dollars can be inflated at an arbitrary rate which is dictated by circumstance, while bitcoins are issued according to a schedule and will only exist in a total amount of 21 million.

If you believe in Bitcoin’s success, it’s probably not a good idea to trust Coinbase with your funds.

Past events are not always relevant for the future, but they can serve as informal education to prevent history from repeating itself.

If you choose to hold your bitcoins on Coinbase, you trust that the company has learned its lessons from the failures of its peers.

On the other hand, if you choose to become your own bank by embracing financial sovereignty, you prove that you have learned the most important lesson about Bitcoin: never trusting third parties with your money.

Is Coinbase Safe for Mass Withdrawals?

Bitcoin was created as a response to a fiat culture which generates arbitrary inflation rates and fractional reserves (where only a fraction of customer’s money is actually available for withdrawals).

When you go to a bank and request to withdraw a large sum of money, it’s likely that the institution will be unable to make the payment on the spot

Instead, they will enforce a daily withdrawal limit on you.

A run on a bank during the great depression - everyone struggles to withdraw their money

Coinbase Withdrawal Limits

When you deal with Coinbase, you must be absolutely certain that the exchange is able to let you withdraw the amount of Bitcoins you bought and hold in their custodial wallet.

Right now, there are no restrictions in regards to how much you can withdraw at one time (at least according to Coinbase’s website).

However, you can never tell when regulations get stricter and it becomes very hard to get your coins out of the exchange due to the increased demands and verification.

Your Bitcoin is Subject to International Relations

If you’re a non-US citizen from one of the supported countries and the United States government ends up having bad diplomatic relations with your national government, then it’s very likely for your funds to get frozen all throughout the conflict.

This happened to Iranian users who were trading on Bittrex and who were affected by the sanctions of US Treasury Department’s Office of Foreign Assets Control (OFAC).

They didn’t get a fair deadline to withdraw their coins and could only hope that the conflict ends as soon as possible and the records don’t get rigged.

Conversely, Coinbase operates in over 100 countries and you can never tell when yours gets targeted by the global financial enforcement of Uncle Sam.

As an American company, Coinbase will have no choice but to comply with the orders given to them by OFAC.

Therefore, it’s unreasonable to assume that the exchange will act in your best interest – especially if you’re not an American citizen and your country can get in conflict with the USA.

Proof of Keys Movement

In order to challenge the power that exchanges have over users and revitalize the ideas that Satoshi Nakamoto introduced to the world, prominent Bitcoiner Trace Mayer organizes an annual event which encourages community members to withdraw all funds from exchanges.

The name of this movement is “Proof of Keys”, takes place on January the 3rd (the same day when Bitcoin’s genesis block was mined) and is meant to be a way of keeping exchanges accountable and honest.

Unfortunately, the numbers reported by exchanges were never threatening for their regular affairs, which means that there are still very few individuals who learned their lessons from the Mt. Gox story.

Proof of Reserves Movement

There is also a movement called “Proof of Reserves” which aims to hold exchanges accountable by demanding for greater transparency.

You can read more about proof of reserves.

In the case of Coinbase, we don’t know for certain how many bitcoins they own, which means that it’s hard to tell whether or not they engage in fractional reserving.

To this day, the only exchange which conducted and passed a proof of reserves audit is Kraken, and the event took place in 2014.

This situation won’t improve if we choose to blindly trust our exchanges, as they are holding scarce money that can’t be restored if stolen.

The blessing and curse of Bitcoin is that all transactions are irreversible, and it’s better to be on the side which uses the feature in a beneficial way for yourself when you become completely sovereign.

If you’re holding bitcoins on Coinbase right now, it’s better to move them to your own wallet while you still can do unrestricted withdrawals.

In the future, limits may be imposed by financial or political actors beyond your control.

And if you’re not managing your own private keys in a non-custodial wallet like a Ledger or a Trezor, then your coins aren’t really yours.

As they say, “Not your keys. Not your coins.”

Does Coinbase Protect Your Privacy?

One delicate topic in the Bitcoin space concerns KYC/AML practices.

Ideologically, most bitcoiners oppose such means of data collection.

However, there are also security reasons to avoid the collection of private data: once the picture of your national ID gets uploaded to a server, it contributes to the reinforcement of a honeypot for hackers.

As presented earlier in the article, Binance has had a big issue with a hacker who managed to download the data of hundreds of users and wanted to extort bitcoins from the exchange.

In the case of Coinbase, you really have no choice but to provide the data.

But if your purpose is to buy some bitcoins and get out, then you can also delete your account and request the company to erase your records – which is a net positive for your privacy and sovereignty.

Furthermore, you should never expect a company to respect your financial privacy in relation to the government.

Legislative changes can happen at any time, and the jurisdiction under which Coinbase operates (the state of California or the Federal Government) can acquire any data at any moment.

This happens a lot in relation to the IRS: in November 2017, Coinbase was ordered to inform the taxman which users have accumulated more than $20.000 in annual transaction volume; within four months, the American exchange also had to send the IRS full personal information and transaction records of users who used the platform between 2013 and 2015.

If you care about financial privacy as a way of protecting yourself from the actions of a government (which once confiscated gold holdings), as well as the greed of people who might try to rob or hack you, then it’s better to be cautious with your digital footprint and the amount of personal data you put in honeypots like Coinbase.

It’s better to move your coins to your own wallet,run a full node , learn about managing UTXOs, and try mixing your BTC with applications such as Wasabi Wallet whenever you want to eliminate links to the sender and acquire some plausible deniability.

Bitcoin is not entirely private, but Coinbase is a financial panopticon which allows governments to track and surveil the kind of currency that they cannot control.

In a panopticon “a guard can see every cell and inmate but the inmates can’t see into the tower.” (source)

Speaking of tracking and surveillance, in 2019 Coinbase acquired blockchain analysis start-up Neutrino in order to better track transactions and associate the data with other individuals and entities.

The most concerning issue, outside of the Orwellian nature of Coinbase, is that Neutrino’s founders have connections with Hacking Team – a company which provided surveillancetechnology to authoritarian governments that infringe fundamental human rights.

This information reveals a lot about Coinbase’s consideration for liberal values and protection of individuals against state oppression.

The safest kind of data is the one that isn’t being processed by any kind of third party.

When it comes to Coinbase, it’s better to regard the platform as a necessary evil and a place that you enter and exit whenever you need.

However, it is not recommended to keep your coins on any exchange for reasons that concern your financial privacy and the security of your coins.

Whenever you are ready to move your bitcoins from Coinbase and enjoy the benefits of financial sovereignty, Billfodl is here to offer you a secure and sturdy way of keeping your private keys offline and away from the eyes of bad actors. Before you make up your mind, find out more about our products.

Conclusion

How you store your coins is a game of tradeoffs.

On the one hand, storing them yourself requires learning about key management (and that presents its own risks).

On the other hand, while it is easier to let Coinbase hold your coins, in many cases, this defeats the purpose of Bitcoin in the first place.

With our team of experts here at Privacy Pros and Billfodl guiding you, it is possible to keep your coins safe all on your own.

Let us show you how…

What is Coinbase?

Overview

Coinbase is currently one of the biggest, most trusted, and most transparent cryptocurrency banks/brokers in the world. Perfectly designed for the new crypto and ICO investors, you can take advantage of this easy-to-use and hassle-free cryptocurrency exchange platform to buy, receive, and trade Bitcoin and other digital currencies and also understand easily about the best ICOs to invest.

Established in 2012 and supported by trusted investors, the platform is headquartered in San Francisco, California and facilitates the crypto exchange service in more than 30 countries with more than 10 million customers.

Unlike traditional cryptocurrency exchanges, this crypto exchange platform enables you to purchase cryptocurrency in exchange for fiat currencies such as USD, EUR, etc.

The platform consists of two core products; one is a broker exchange and other is a professional trading platform named GDAX. Both these products function differently and independently from each other.

Now the question, is who can use this platform?

Coinbase can be used by the following people:

First-time Bitcoin buyers: If you are a first-time crypto buyer, you can use this platform to make your purchases.

Those seeking a secure place to buy Bitcoin: If you are seeking a safe place that you can use to buy Bitcoin, this place is for you.

Those wanting to pay with a credit card or by bank transfer: If you wish to make payments for your purchases, then this platform is suitable.

Ready to provide identification details: If you are not afraid of handing over your identification details, then you can trust this platform.

Not using this platform to gamble online: Finally, yet importantly, the platform is not to be used for gambling purposes. If you are not looking to gamble online, then this is an ideal place for fair crypto selling, buying, and trading.

If the above-mentioned elements apply to you, then this is the right cryptocurrency platform for you.

How to set up an account with Coinbase?

Signing up with this platform is exceedingly simple and hassle-free in comparison with other crypto-exchange platforms that already exist in the crypto landscape. In order to create an account, you just need to follow and complete just a few key steps such as:

Go to its website, open its joining page and then enter the required details (see the image below for an example).

Once you have successfully completed the above process, the platform will send you an email asking you to verify it. As you click the account verification link contained in the email, it will redirect you to its website, where you can go ahead with your identity verification. When you have verified your identity, simply select the type of payment you wish to make via this platform.

How to buy cryptocurrency from Coinbase?

After the sign-up process, you need to choose a type of account. There are two types of account: individual and business. You need to choose between these two accounts. Once you have gone through this process, you can jump ahead to the next step (see the image for more information).

Verify your phone number

When you have successfully selected your account, it will ask you to enter your phone number for verification. The company uses this number as a form of 2-Factor Authentication, thus providing full security to your personal account. The below image will best illustrate it:

Set up your payment method

After your phone number has been verified, you need to set up your payment method (see image below).

It is to be noted that this crypto exchange platform accepts payment via bank transfer and credit card.

When you set up your bank account with this platform, you must make two small transactions and verify the amounts.

When you set up a credit card, the platform also asks you to upload an image of your credit card.

As with other crypto exchanges handling fiat currencies such as USD, EUR, etc, this crypto exchange platform mandates both these methods to abide by various government regulations.

Now it’s time to buy Bitcoin, Ethereum, and/or Litecoin

When you have completed the above process, you can start buying your cryptocurrency. This platform clearly states its fees and prices while you are placing your order (see below for the crypto purchasing step).

Your account will now show you the credited amount of cryptocurrency.

How safe and secure is Coinbase to use?

The safety and security of funds are what most concerns crypto buyers. Nobody wants to deposit his/her funds into a bank/exchange that does not guarantee security of funds. However, this platform is well-known for the safety, security, and transparency of its users’ funds. These key elements actually best define this crypto-exchange platform.

So, on the security front, this platform easily provides three layers of security to its users.

Complying with all necessary U.S. laws and regulations

Coinbase is a fully legitimate company, which complies with all necessary U.S. laws and regulations required to run a company in the United States, at both a state and federal level.

Some of the key legislations, regulations, and regulatory bodies this platform abides by are as follows:

- It complies with state money transmission laws and regulations.

- It is registered with FinCEN as a Money Services Business.

- It complies with the Bank Secrecy Act.

- It complies with the USA Patriot Act.

Abiding by all these legislations and regulations, this platform fulfils its responsibility to provide its users with a law-abiding and fully secure payment transactions service, as opposed to other crypto exchanges operating in many different countries. Apart from the United States, none of the countries from where this platform operates mandates licenses to run a cryptocurrency business. Besides, it is also important to note that cryptocurrency is supported by many trustworthy investors such as Alexis Ohanian (Reddit Co-Founder), Blockchain Capital, Bank of Tokyo, and Digital Currency Group.

Guarantee of funds security

Unlike other crypto exchanges, Coinbase keeps its customer funds segregated from the company’s operational funds. The company holds these funds in custodial bank accounts.This indicates that it won’t exploit your funds to run its business. Moreover, the company itself says that if ever it becomes insolvent, neither this platform nor its creditors can claim the funds held in the custodial bank accounts. The funds held in those accounts will be returned only to the Coinbase’s customers.

It is important to note that 98% of customers’ funds are held in secure offline cold storage. These funds are stored on various paper wallets and hardware wallets. The physical cryptocurrency wallets are later held in safety deposit boxes and vaults (a new feature that allows you to “share an account” with 2 or more users) throughout the globe. These measures help in securing customers’ funds from being hacked or stolen by hackers.

Personal account security

Apart from ensuring security for your cryptocurrency funds, this platform also secures your personal account with multiple 2-factor authentication (2FA) methods. One of the most basic methods that you can adopt is via SMS texts, but it is advisable to set up a third party 2FA app. You can choose from options such as Google Authenticator and Authy. In addition, the system also allows you to monitor all your account activities. It also notifies you when someone tries to maliciously access your account.

Coinbase’s customer support

This crypto platform though has an extensive FAQ section to answer general questions. If you face any technical issues while navigating the site, this platform offers 24/7 hours customer support service via email.

Countries serviced by Coinbase

Countries supported and serviced by Coinbase include: the United Kingdom, France, Greece, Norway, Poland, Sweden, Switzerland, Denmark, Finland, Monaco, the Netherlands, Slovenia, Spain, Cyprus, Czech Republic, Lichtenstein, Malta, San Marino, Slovakia, Bulgaria, Croatia, Italy, Latvia, Portugal, Romania, Austria, Belgium, Hungary, and Ireland.

Coinbase’s buying and selling limits

Buying and selling limits depend upon the type of payment method you choose, country you reside in, and your verification status.

For example, if you are a fully verified US customer, the weekly limits will be similar to the following:

- USD50 buy through a credit/debit card

- USD5,000 buy through a bank account

- USD50,000 sell

If these limits aren’t enough for your requirements, you can choose to apply for higher limits. It is notable that your limits for immediate purchases, as credit card purchases, must not go beyond the pre-decided limit. Interestingly if you are a European customer, you may get up to €30,000 in your account.

Coinbase Exchange Faq Login

Send cryptocurrency from your crypto wallet to Coinbase

You can leverage the advantage of a Coinbase wallet to easily send, receive, and store cryptocurrency. All you need to do is complete a few simple steps (see below) before hitting the “Send Funds” button to send Bitcoin, Ethereum, and Litecoin from your wallet:

- Navigate to the Send tab of your account.

- Select the wallet you wish to send from, effectively opting for what cryptocurrency you are sending.

- Enter the amount you would like to send.

- Enter the address you wish to send funds to.

- Send funds.

Send cryptocurrency from Coinbase to your crypto wallet

Just as sending cryptocurrency from your crypto wallet to Coinbase is easily done, it is also very simple to receive cryptocurrency via this platform. All you need to do is:

- Navigate to your “Accounts” tab.

- Check the wallet where you would like to send the funds.

- Click the “Receive” button.

Coinbase Exchange Faq Online

Now you can get your account’s wallet address and use it in the sent field of a transaction to receive cryptocurrency.

Coinbase fees

The fees structure of this platform continues to change, ranging from 0 to 200 basis points. However, you will be required to pay conversion charges when it comes to transferring from bank accounts or purchasing with credit/debit cards.

User warning while using Coinbase

This cryptocurrency exchange platform takes every possible measure to stop the misuse of its platform. It monitors its users every time cryptocurrency is sent and received via its platform and places restrictions if a user is found to be involved in the following activities:

- Sending cryptocurrency for darknet purchases.

- Sending cryptocurrency to gambling sites.

- Sending cryptocurrency to LocalBitcoins.

In case of closed accounts due to above activities, users will receive a refund to their bank accounts.

Is Coinbase a wallet?

Coinbase is not exactly a wallet, but it can be used as a wallet. The multi-utility platform also provides extra security for those wanting to store their funds for a longer term called “Vault.” This again raises the same question of whether it is a safe platform or not. The answer is yes, as it always prioritizes your funds and personal account security.

Summarizing Coinbase

This is an amazing crypto exchange platform when it comes to sending, receiving, and trading (through GDAX) cryptocurrency. As opposed to other crypto exchanges, this platform is the most trusted, biggest, safest and most transparent cryptocurrency exchange. It is not just easy to use but also offers more payment methods, providing an outstanding crypto transferring and transacting experience to its users.

Although some believe it to be more of a wallet than a crypto exchange platform, it does allow you to create three types of wallets such as Coinbase Bitcoin wallet, Coinbase vault, Multisig vault.

Thus, this platform is an entry gate to the crypto market and lets you buy Bitcoin, Litecoin, Ethereum, and Bitcoin Cash which are the most common what comes to invest in ICO’s.