These transactions are free:

- Paying a merchant directly from your Skrill wallet

- Receiving money to your Skrill account

- Sending money to an international bank account with Skrill Money Transfer

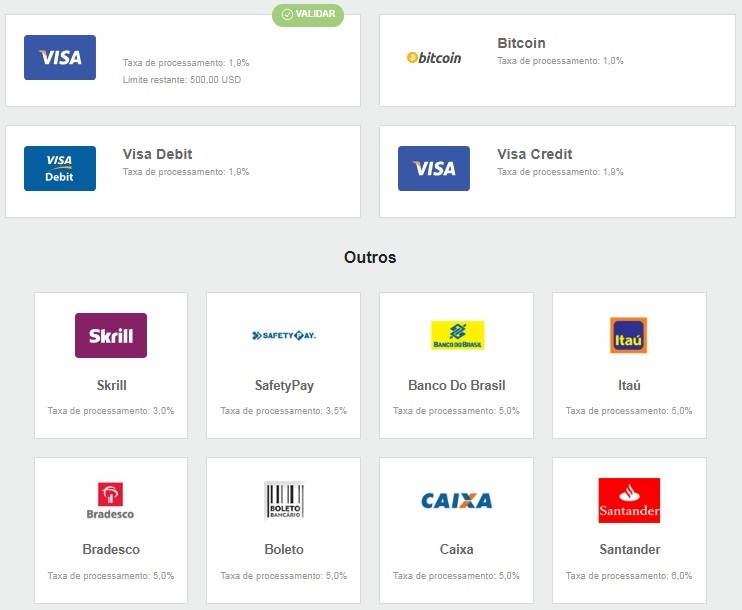

Local payment methods

STICPAY is your secure and fast eWallet for international money transfers and online payments. Open a free account now. A NETELLER Account lets you send and receive money and make fast, secure online payments whenever you need to, to whoever you need to.

NETELLER transactions. For all transactions involving currency conversion, NETELLER adds 4.49% to the average daily interbank market rate published by a third-party foreign currency data provider. NETELLER retains this amount as a foreign exchange processing fee to protect against exchange rate fluctuations. Lower exchange rates for VIP members.

Global payment methods

Please note that if you use your credit card for gambling purposes your issuer may charge a ‘cash advance' fee. This fee is outside Skrill’s control, and we receive no part of it.

Local payment methods

Global payment methods

Skrill Money Transfer

International Transfer

FreeNo fee when you use Skrill Money Transfer to send money to an international bank account.

International transfer in the same send and receive currency only

International transfer exchange rate mark-up

Up to 4.99%Exchange rate mark-up fee per transaction.

Domestic Transfer

Up to 2%

Domestic fee per transaction. This fee will be charged when the transfer begins and ends in the same country.

Receive money

FreeSkrill Money Transfer does not charge recipients any fee to receive

Skrill to Skrill

Send money

1.45%*

1.45%, min 0.50 EUR fee is applied if you have funded your wallet via Card or Bank Account.

*If you haven't made any deposit to your Skrill account, or have deposited via NETELLER, paysafecard or BitPay, a higher fee of 4.49%, min 0.50 EUR will apply.

FreeReceive money

Receiving money is always free of charge

Taxas Da Neteller

You will see the applicable fee before you complete your transaction.

Keep Skrilling

Your Skrill account is free for personal use as long as you log in or make a transaction at least every 12 months.

Taxa Neteller Transferencia

Otherwise a service fee of EUR 5.00 (or equivalent) will be deducted monthly from your account.

Currency conversion

For transactions involving currency conversion Skrill adds a fee of 3.99% to our wholesale exchange rates. The exchange rates vary and will be applied immediately without notice to you.

If your Skrill Account is denominated in a currency other than Euro, your Cryptocurrency Transactions will be subject to currency conversions. In this case, we will apply foreign exchange fee of 1.5%.

Prepaid card fees

Taxa Neteller Para Iq Option

Our fees are transparent, so you always know where you stand. Here are the fees we charge for using our Skrill Prepaid Mastercard®:

- 10 EUR card application

- 10 EUR annual fee

- 3.99 % FX fee

- 1.75 % ATM fee

- POS transactions are free

- Skrill virtual card application – first is free, any subsequent card is 2.5 EUR.

Simple and transparent fees

Crypto Buy / Crypto Sell | Fee: |

|---|---|

| Transactions up to EUR 19.99 | EUR 0.99 per transaction |

| Transactions between EUR 20 – EUR 99.99 | EUR 1.99 per transaction |

| Transactions above EUR 100 | 1.50 % per transaction |

Crypto P2P | Fee: 0.50 % per transaction |

Important Please note that the Skrill Cryptocurrency Service is not regulated by the Central Bank of Ireland. | |

In accordance with the Skrill Account Terms of Use:

Taxas Neteller Ou Skrill

| Provision of inaccurate or untruthful information and lack of cooperation fee (s. 4.5) | up to EUR 150 |

| Chargeback fee (s. 8.3) | EUR 25 per chargeback |

| Attempted cash upload fee (s. 8.12) | EUR 10 per upload |

| Prohibited Transactions fees (s. 11) | up to EUR 150 per instance |

| Reversal of a wrong transaction fee (s. 12.7) | up to EUR 25 per reversal attempt |